The 6-Second Trick For Hsmb Advisory Llc

The 6-Second Trick For Hsmb Advisory Llc

Blog Article

The smart Trick of Hsmb Advisory Llc That Nobody is Talking About

Table of ContentsAn Unbiased View of Hsmb Advisory LlcExcitement About Hsmb Advisory LlcNot known Incorrect Statements About Hsmb Advisory Llc Hsmb Advisory Llc for DummiesFacts About Hsmb Advisory Llc RevealedThings about Hsmb Advisory Llc

If the policy proprietor is under 59, any taxed withdrawal may likewise be subject to a 10% federal tax obligation charge. All whole life insurance plan guarantees are subject to the prompt payment of all required premiums and the insurance claims paying capability of the issuing insurance coverage company.

The cash abandonment value, car loan worth and fatality profits payable will certainly be minimized by any type of lien impressive due to the payment of an increased advantage under this motorcyclist. The accelerated advantages in the initial year mirror reduction of an one-time $250 administrative cost, indexed at a rising cost of living rate of 3% annually to the price of acceleration.

Little Known Facts About Hsmb Advisory Llc.

A Waiver of Costs cyclist waives the responsibility for the policyholder to pay further costs must he or she come to be totally impaired constantly for at the very least 6 months. This rider will certainly sustain an added cost. See plan contract for additional details and needs.

Below are numerous cons of life insurance policy: One negative aspect of life insurance policy is that the older you are, the much more you'll spend for a policy. This is due to the fact that you're more probable to die during the plan duration than a more youthful insurance policy holder and will, consequently, set you back the life insurance policy firm more cash.

While this may be a plus, there's no assurance of high returns. 2 If you choose a long-term life plan, such as whole life insurance policy or variable life insurance policy, you'll get long-lasting insurance coverage. The caveat, nevertheless, is that your costs will be higher. 2 If you're interested in life insurance policy, consider these suggestions:3 Do not wait to look for a life insurance policy policy.

How Hsmb Advisory Llc can Save You Time, Stress, and Money.

By making an application for life insurance policy protection, you'll have the ability to assist secure your loved ones and gain some comfort. Aflac's term and entire life insurance coverage plans can give you extensive protection, premiums that fit most budget plans, and other advantages. If you're uncertain of what sort of coverage you ought to obtain, call an agent to discuss your options - Insurance Advise.

There are several prospective benefits of life insurance policy but it's usually the confidence it can supply that matters one of the most - http://prsync.com/hsmb-advisory-llc/. This is because a payout from life cover can serve as an economic safety and security internet for your liked ones to draw on should you pass away while your plan is in area

The bypassing advantage to all is that it can take away at the very least one worry from those you care around at a challenging time. Life insurance can be established to cover a home mortgage, potentially aiding your family members to remain in their home if you were to pass away. A payout can help your dependants change any kind of income shortage really felt by the loss of your incomes.

The Best Guide To Hsmb Advisory Llc

A payment could be used to help cover the cost of your funeral. Life cover can help mitigate if you have little in the way of savings. Life insurance policy products can be utilized as part of estate tax planning in order to lower or prevent this tax. Putting a plan in trust can supply greater control over possessions and faster payments.

You're hopefully eliminating a few of the stress really felt by those you leave behind. You have satisfaction that enjoyed ones have a particular degree of financial security to draw on. Getting life insurance policy to cover your mortgage can offer comfort your home loan will be settled, and your loved ones can proceed living where they have actually constantly lived, if you were to die.

Things about Hsmb Advisory Llc

Arrearages are generally repaid utilizing the value of an estate, so if a life insurance policy payout can cover what you owe, see it here there should be more delegated pass on as an inheritance. According to Sunlife, the ordinary price of a standard funeral service in the UK in 2021 was simply over 4,000.

The Single Strategy To Use For Hsmb Advisory Llc

It's a considerable amount of money, but one which you can provide your enjoyed ones the chance to cover using a life insurance policy payment. You ought to consult your company on details of how and when payments are made to ensure the funds can be accessed in time to pay for a funeral.

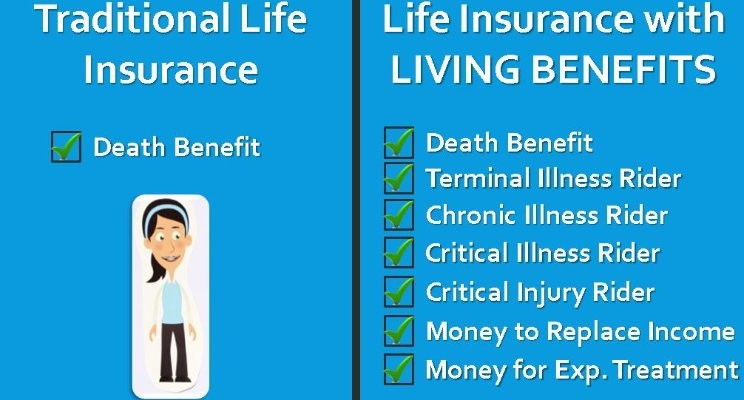

It might also provide you extra control over who receives the payment, and aid reduce the possibility that the funds could be used to settle financial debts, as might take place if the policy was beyond a trust. Some life insurance plans consist of a terminal ailment benefit option at no additional expense, which might cause your plan paying early if you're detected as terminally sick.

A very early settlement can permit you the chance to obtain your events in order and to maximize the moment you have left. Losing a person you love is tough enough to handle in itself. If you can help alleviate any kind of worries that those you leave could have concerning just how they'll cope financially moving on, they can concentrate on things that actually need to matter at the most hard of times.

Report this page